Responsabilidad Civil General para Contratistas de Concreto

Responsabilidad Civil General para Contratistas de Concreto – Como contratista de concreto, usted trabaja duro cada día para construir estructuras fuertes y duraderas para sus clientes. Sin embargo, incluso con las mejores intenciones y la mano de obra más cualificada, pueden ocurrir accidentes. Por eso es esencial contar con un seguro de responsabilidad civil general […]

How Much General Liability Insurance for Small Business?

How Much General Liability Insurance for Small Business As a small business owner, there are many factors to consider when it comes to protecting your company. One of the most important is general liability insurance, which can help safeguard your business against a range of potential risks and liabilities. But with so many options and […]

How Much is Contractor Insurance: How Much Should You Pay?

How Much is Contractor Insurance: How Much Should You Expect to Pay? As a construction contractor, it’s essential to protect yourself, your employees, and your business from unexpected events that can lead to financial losses. That’s why contractor insurance is critical. However, the cost of insurance can vary depending on several factors, such as the […]

General Liability Covers: The Importance of GL Insurance

As a business owner, you have invested a lot of time, money, and effort into building your company. You have worked hard to create a product or service that meets the needs of your customers and provides value to the community. However, with the many risks that come with running a business, it is important […]

General Liabilities Definition: What You Need to Know

General Liabilities Definition: What You Need to Know When it comes to running a business, there are numerous risks that can arise at any moment. From accidents that occur on your premises to lawsuits filed by dissatisfied customers, it’s essential to understand the concept of general liabilities. Simply put, general liabilities refer to the legal […]

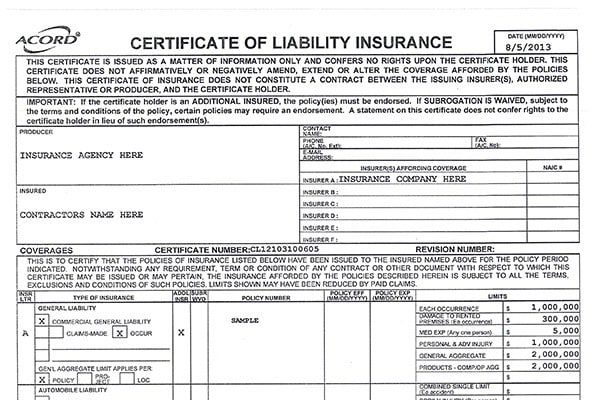

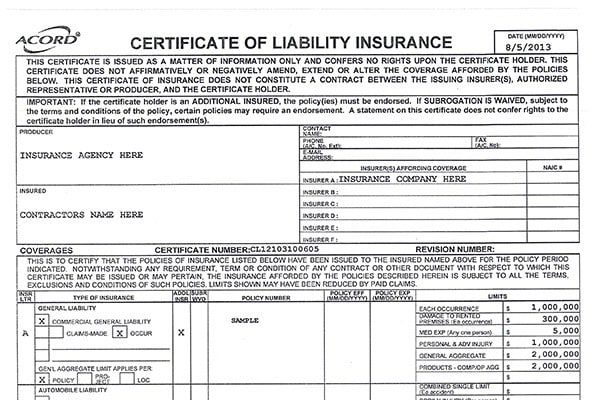

General Liability Waiver of Subrogation: What is the Importance?

Are you a business owner, contractor, or property owner? Have you ever heard of a general liability waiver of subrogation? If not, it’s time to take notice. A general liability waiver of subrogation is a clause that can protect you and your business from potential lawsuits and claims. It’s a legal document that releases one […]

General Liability Insurance Small Business Cost: How to Save

General liability insurance for a small business can be a significant cost, but is an essential part of any business’s risk management strategy. As a small business owner, you know how important it is to protect your company from potential risks and liabilities. However, that doesn’t mean you have to break the bank to get […]

Gutter Installation Workers’ Compensation: A Guide for Employers

Gutter installation is a physically demanding job that comes with inherent risks. As an employer in the gutter installation industry, it is crucial to prioritize the safety and well-being of your workers. One vital aspect of ensuring their protection is understanding the intricacies of workers’ compensation. In this guide, we will delve into the key […]

Gutter Installation General Liability: What to Know

As a gutter installation business owner, it’s important to understand general liability requirements. This guide covers everything you need to know to keep your team safe and covered. What is gutter installer general liability insurance? General liability insurance is a type of insurance that provides coverage for a business in case of third-party claims for […]

Pressure Washing Workers Compensation: How Does It Work?

If you’re running a pressure washing business, it’s important to understand the rules and regulations surrounding workers’ compensation. This type of insurance can protect your employees in case of injury or illness on the job, but there are specific requirements that must be met. Read on to learn more about pressure washing workers compensation and […]