What is Farm Bureau: It Benefits Members Through Insurance

Are you a farmer or involved in agriculture? Consider joining Farm Bureau for access to a variety of insurance options designed specifically for your needs. From crop insurance to liability coverage, discover the benefits of becoming a member today. Click here for a fast home or auto quote. What is Farm Bureau? Farm Bureau is […]

USAA Quote Auto: The Ultimate Solution to Buying Auto Insurance

USAA Quotes Auto – are you tired of the hassle and confusion that comes with buying auto insurance? Look no further than a USAA Auto Quote, the ultimate solution to simplify the process. With their commitment to serving military members and their families, USAA offers competitive rates and personalized coverage options to fit your unique […]

General Liability Insurance for Tree Service: Learn More

General Liability Insurance for Tree Service – as a tree service business owner, you know that accidents can happen at any time. Whether it’s a falling branch, a damaged property, or an injured worker, it’s essential to have the right insurance coverage to protect your business from financial loss. That’s where general liability insurance comes […]

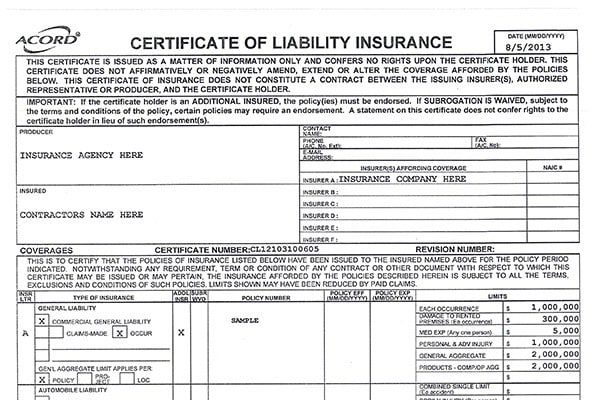

Contractor Insurance Certificate: 5 Things You Need to Know

As a contractor, it’s important to have insurance to protect your business from potential risks and liabilities. One essential document you’ll need is a contractor insurance certificate. If you’re not sure where to start, this guide will walk you through the process of obtaining one, so you can have peace of mind and focus on […]

General Liability Business Insurance is Essential to Your Company

As a business owner, you know that unexpected accidents and incidents can happen at any time. That’s why it’s important to protect your company with general liability business insurance. This type of insurance can help cover legal and financial risks, such as property damage, bodily injury, and advertising injury. Learn more about the benefits of […]

Contractor Workers’ Comp Insurance: A Comprehensive Guide

As a contractor, you understand the importance of protecting your business and employees. One essential form of protection is workers’ compensation insurance, which provides benefits to employees who are injured or become ill on the job. This guide will cover everything you need to know about contractor workers comp insurance, including what it is, why […]

General Liability Roofing Insurance: Protect Your Business

General Liability Roofing Insurance – roofing can be a highly profitable business, but it also comes with its fair share of risks. From accidents on the job site to property damage caused by your work, there are plenty of situations that could lead to costly claims against your business. This is where general liability roofing […]

What General Liability Insurance Covers: The Ultimate Guide

What General Liability Insurance Covers – General Liability Insurance is a crucial aspect of any business, whether big or small. It protects your company from financial losses that may arise from lawsuits or claims filed against you for property damage, bodily injury, or advertising injury. However, understanding what General Liability Insurance covers can be challenging, […]

What Does Contractor Insurance Cover: The Fine Print

What Does Contractor Insurance Cover – as a contractor, you know that accidents can happen at any time, whether you’re working on a construction site or in a client’s home. That’s why contractor insurance is essential for protecting your business and ensuring that you’re prepared for any unexpected event. But what exactly does contractor insurance […]

Insurance Companies Texas: What You Need to Know

Insurance Companies Texas – as a Texan, you understand the importance of having reliable insurance coverage. Whether it’s for your car, home, or health, insurance provides a safety net in the event of unexpected accidents or emergencies. However, with so many insurance companies operating in Texas, it can be overwhelming to choose the right one. […]