Seguro Comercial para Truck: Todo lo que Necesitas Saber

Seguro Comercial para Truck – ¿Eres propietario de un camión y necesitas proteger tu inversión? Entonces, estás en el lugar correcto. En este artículo, descubrirás todo lo que necesitas saber sobre el seguro comercial para camiones. Desde cómo funciona hasta por qué es esencial tenerlo, te proporcionaremos la información más actualizada y confiable para que […]

Markel Insurance: Global Specialty Insurance

Markel Insurance – In the complex and ever-evolving landscape of insurance, finding a partner that understands your unique risks and offers tailored coverage is crucial. Markel Insurance, a global leader in specialty insurance, has been providing innovative solutions for over 90 years. With a strong commitment to understanding the specific needs of its clients, Markel […]

Stillwater Insurance: How a Policy Can Safeguard Your Future

Stillwater Insurance – Are you prepared for the unexpected? Life is full of uncertainties, and it is important to have a safety net in place to protect yourself and your loved ones. That’s where Stillwater Insurance comes in. With their comprehensive policies, you can safeguard your future and gain peace of mind knowing that you […]

Car Insurance Premiums: A Comprehensive Guide For Best Deals

Car insurance https://ameriagency.com/wp-content/uploads/2023/06/My-Promo-video-84-3.mp4 Car Insurance – are you tired of paying high car insurance premiums? Look no further! In this comprehensive guide, we will explore the best deals available to help you save money on your car insurance. With rising costs and countless options to choose from, finding the right coverage at an affordable price […]

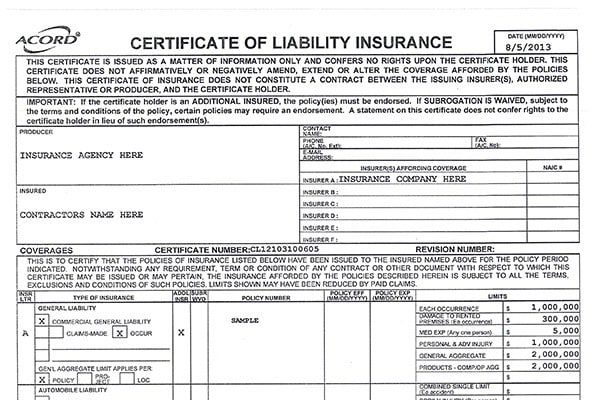

Why a Preferred Contractors Insurance Company is Best

As a contractor, you understand the importance of having the right insurance coverage to protect your business. But with so many options out there, how do you choose the best insurance company for your needs? A preferred contractors insurance company may be the ideal choice, offering tailored coverage and specialized services to meet the unique […]

Seguro de Camiones de Larga Distancia

Seguro de Camiones de Larga Distancia – Si estás buscando cómo sacar una aseguranza de trabajo para tu camion, has venido al lugar correcto. Aquí te ayudaremos a que puedas hacerlo fácilmente con las mejores opciones ofrecidas por nuestra aseguradora. Descubre todo lo que necesitas saber sobre cómo conseguir la mejor protección para tu viaje […]

GEICO Commercial Auto Insurance – Review

Are you considering GEICO for your commercial auto insurance? You may be wondering what kind of plans are available, and if they fit your business’s needs. Here, we take a look at their coverage options, as well as any additional discounts or benefits that come with choosing GEICO. Overview of GEICO Commercial Auto Insurance. GEICO […]

Seguro de Negocio: 5 cosas que debes saber

El seguro de negocio es una herramienta importante para proteger a una empresa contra los riesgos financieros asociados con incidentes imprevistos. Este tipo de seguro proporciona protección contra eventos como incendios, robos, lesiones a terceros y demandas por responsabilidad civil, lo que puede ayudar a garantizar la continuidad y el éxito a largo plazo del […]

Seguro de Auto Barato: Como Encontrar la Mejor

El seguro de auto es una de las obligaciones más importantes a la hora de tener un vehículo. Protege a los conductores y a sus vehículos en caso de accidentes o daños. Sin embargo, encontrar un seguro de auto barato puede ser un desafío, especialmente en un mercado donde los precios a menudo son elevados. […]

Hanover Insurance Review: Take a Closer Look

Hanover Insurance review – In the ever-evolving world of insurance, finding the right policy tailored to your needs can feel like navigating a labyrinth. But fear not, for we’re here to decode the complexities and unveil the insider insights of insurance policies. Welcome to our in-depth review, where we unravel the intricacies of insurance options, […]