Insurance for General Contractor: Safeguarding Your Profits

Insurance for General Contractor – As a general contractor, you’re responsible for overseeing multiple construction projects simultaneously. With so many moving parts, it’s essential to protect yourself and your business from potential risks. That’s where insurance comes in. Insurance for general contractors serves as a safety net, safeguarding your projects and preserving your profits. From […]

Insurance Commercial: 5 Must Have Polices

Insurance Commercial – Are you a business owner looking to protect your company against unexpected risks? As a savvy entrepreneur, you understand the importance of having insurance policies in place to safeguard your business. In this article, we will delve into the top 5 must-have insurance policies for commercial enterprises. First on the list is […]

General Liabilities Definition: What You Need to Know

General Liabilities Definition: What You Need to Know When it comes to running a business, there are numerous risks that can arise at any moment. From accidents that occur on your premises to lawsuits filed by dissatisfied customers, it’s essential to understand the concept of general liabilities. Simply put, general liabilities refer to the legal […]

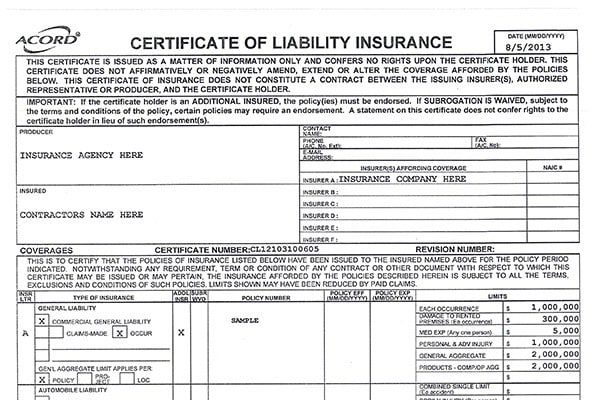

Contractor Insurance Limits: The Essential Guide to Understanding

As an independent contractor, having the right contractor insurance limits is essential to protect your livelihood. Understanding exactly what is and isn’t covered by your policy, as well as other best practices for proper insurance coverage, will help you stay secure and successful in any job. Insurance For Restoration Contractors: The Essential Policies. What is […]

Contractor GL and Work Comp: The Most Important Coverages

Contractor General Liability and Work Comp – Being a construction contractor comes with its own set of risks and challenges. From accidents on the job site to property damage and legal liabilities, there are numerous situations that can put your business at risk. That’s why having the right insurance coverage is essential for construction contractors. […]

Roofers Workers Comp Insurance – What You Should Know

As a roofer, it’s important to make sure you have the proper Roofers Workers Comp Insurance. Here’s what you need to know about this type of coverage, the kinds of coverage available, and the benefits for having workers comp insurance for your business. What is Roofers Workers Comp Insurance? Workers Comp Insurance is a form […]

The Best Tennessee Cyber Insurance For My Business

Tennessee business owners can now access comprehensive cyber insurance to protect their data, networks, and systems from threats like malware, phishing scams, ransomware, and identity theft. Learn about the best coverage for you here, tailored to your needs and budget. Evaluate Your Cyber Risks Before selecting cyber insurance in Tennessee, it’s important to evaluate your […]

Cheap Insurance KY – How to Find It?

Cheap insurance is something that many people in Kentucky are looking for. While insurance is a necessity, it can also be expensive, making it difficult for some people to afford. If you are looking for cheap insurance in KY, there are a few things you can do to find the best deals. First, it’s important […]

Time Element Coverage Forms: A Comprehensive Guide

Navigating time element coverage forms can be confusing and overwhelming, but understanding them is essential for any manufacturer or business owner. In this guide, we’ll cover what time element coverage is, why it’s important, and how you can use it to protect your business. What Are Time Element Coverage Forms? Time element coverage forms are […]

Commercial Lines: What Business Owners Need to Know

Commercial Lines of Insurance – Navigating the complex landscape of commercial lines insurance can be daunting for business owners. From property and liability coverage to specialized policies for unique business needs, finding the right insurance can seem like deciphering a hidden code. Understanding the intricacies of commercial insurance is vital to safeguarding a business from […]