Electrical subcontractor insurance explained.

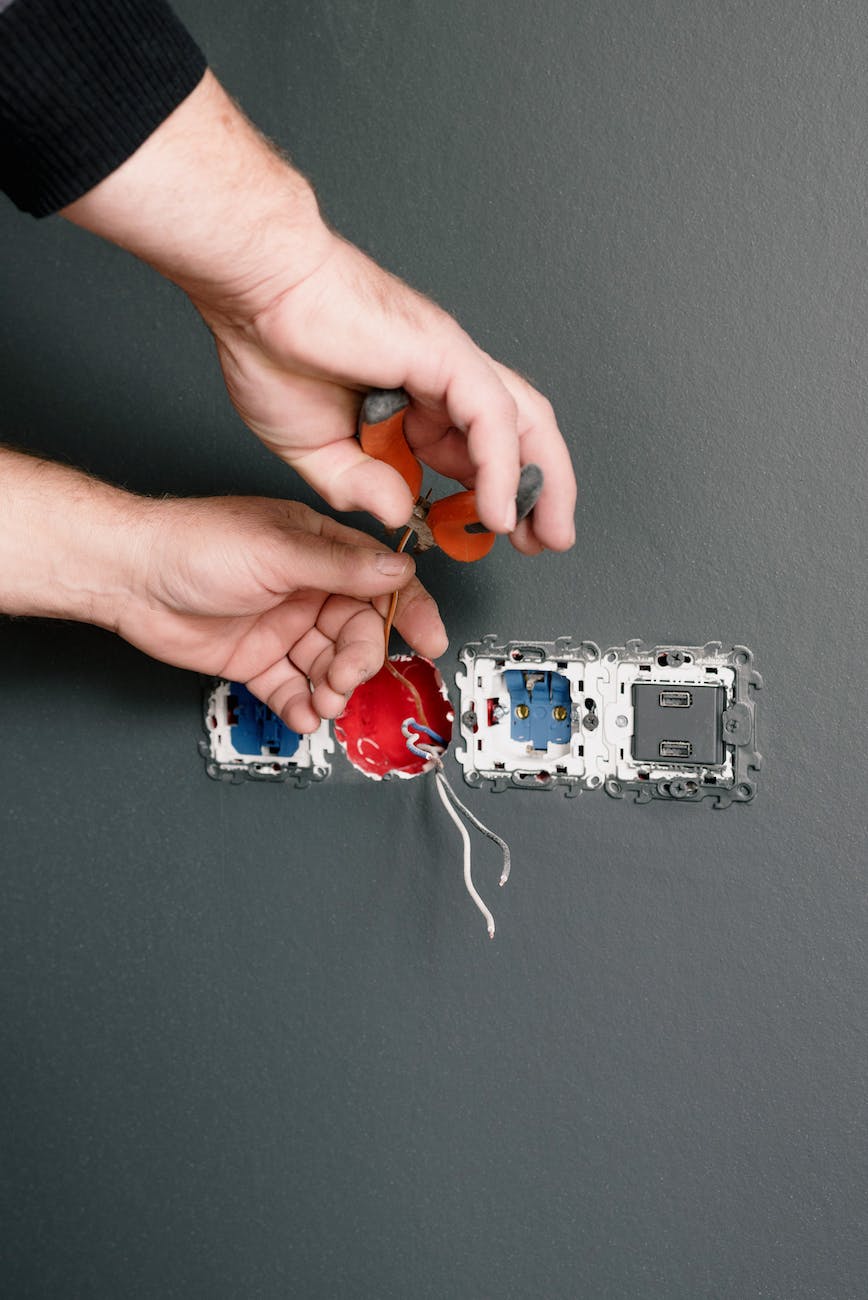

Electricians with electrical subcontractor insurance make the connections that allow electricity to flow and power homes and businesses. From lights to computers and from appliances to televisions, people rely on the services that you provide to make their lives easier and more convenient.

Electrical subcontractors insurance is needed to install, service, maintain and repair electrical wiring, conduits and fixtures both inside and outside residential and commercial buildings. Inside contractors install electrical wiring used for powering machinery, equipment, and lighting systems. Outside contractors install overhead power lines and underground electrical cables.

Most states require electrical subcontractors to be licensed. An electrical contractor may provide 24-hour emergency service with electrical subcontractor insurance. Click here if you are a contractor in a different field?

While the services you provide are invaluable, what happens if an accident occurs or if you damage someone’s property? You could be held liable for medical expenses, the repair or replacement of damaged property, and even legal action. Electrical subcontractors insurance can protect you from severe financial strain and devastation.

As an electrician, there are several types of electrical contractors insurance policies that can protect you, your business, your employees, and your clients. Some of the most important coverages electrical contractors should carry include:

General liability insurance for electrical subcontractors. If a third party sustains an injury or their property is damaged as a result of the services that you provide, professional liability coverage will protect you from the costs that are associated with medical bills and repairing or replacing the damaged property. If a client files a lawsuit against you, this type of policy will help pay for legal defense fees. For instance, if a faulty connection damages appliances, your CGL would help to pay for those damages.

Errors and omissions for electrical subcontractors. This type of policy offers protection for any negligence claims that are filed against you, as well as for claims stating that you failed to perform a service you promised. Errors and omissions insurance provides coverage for negligence (whether true or alleged), legal defense fees, and damages that occur after you completed your service.

Commercial property. If your business out of a physical location, it’s a wise idea to carry commercial property insurance. This policy will protect the building your business is located in, as well as the contents within it. If an act of vandalism is committed or your building or property are damaged in a storm, this coverage will help pay for any necessary repairs or replacements.

Workers’ compensation for electrical subcontractors. No electrical subcontractor insurance is complete without workers’ compensation. If you employ a staff, workers compensation insurance is a must; in fact, in most states it’s a legal requirement. This type of coverage will pay for any injuries or illnesses your employees may sustain while they are on the job. For instance, if a worker is connecting wires and is electrocuted, workers’ compensation will help cover the cost of medical care and lost wages. If an employee perishes as a result of an accident, this policy will also pay out death benefits to his or her dependents.

Inland Marine Coverage for your tools and equipment. You use expensive tools while you’re on the job, and if those tools are damaged, the cost of replacing them can be extensive. Contractors’ equipment coverage will protect the tools and equipment you use on job sites. Call AmeriAgency at 888-851-5572 to get the best electrical subcontractor insurance.