The Top 10 Ameri Cars You Need to Know About

If you’re a fan of American-made cars, you’ll want to check out this guide to the top 10 Ameri cars. From classic muscle cars to modern luxury vehicles, we’ve got you covered with all the information you need to know about these iconic automobiles. Get ready to rev your engines and hit the road in […]

Contractor Insurance Audit: What You Need Do

As a contractor, it’s important to make sure you have the right insurance coverage to protect your business and clients. One way to ensure you have adequate coverage is through a contractor insurance audit. In this article, we’ll cover the basics of why an audit is essential and what you can expect during the process. […]

How to Access Your BiBerk Account: A Guide to BiBerk Login

If you’re a BiBerk customer, you’ll need to log in to your account to manage your policies, make payments, and access important documents. Fortunately, the BiBerk login process is straightforward and can be completed in just a few simple steps. Follow this guide to get started today. Go to the BiBerk website. The first step […]

Top 10 High-Paid Construction Jobs You Should Consider

If you’re interested in a career in construction and want to earn a high salary, there are plenty of options to choose from. From project managers to engineers, we’ve compiled a list of the top 10 high-paid construction jobs to help you plan your future in this exciting industry. 10 High-Paid Construction Jobs: Construction Manager […]

What is Non Owner’s Auto Insurance, and Who Needs It?

If you’re someone who doesn’t own a car but still drive regularly, you may have heard of non owner’s auto insurance. This type of insurance can provide coverage for drivers who don’t have their own vehicle but still need protection in case of an accident. In this post, we’ll explore what non owner’s auto insurance […]

Cómo Ahorrar Dinero en tu Seguro de Carro

Cómo ahorrar dinero en tu seguro de carro El seguro de carro es un gasto necesario para cualquier propietario de un vehículo, ya que ayuda a proteger tanto a la persona como al automóvil en caso de un accidente. Sin embargo, el costo de un seguro de carro puede ser bastante elevado, especialmente si no […]

Seguros de Auto 101: Guía Para Entender los Seguros de Auto

Cuando compras un auto, es importante considerar la protección de tu vehículo y de terceros. Para ello, existen los seguros de auto o aseguranzas de carro, que son un contrato entre el propietario del vehículo y una compañía de seguros. En este artículo, te explicamos los conceptos básicos sobre los seguros de auto. ¿Qué son […]

Liability Insurance in Spanish: ¿Qué es responsabilidad civil?

Si tienes un negocio o empresa, es importante que te protejas contra posibles reclamaciones de responsabilidad civil. En este artículo, aprenderás todo lo que necesitas saber sobre el seguro de responsabilidad civil, incluyendo qué cubre, cómo funciona y cómo obtenerlo. Mantén tu negocio seguro y protegido con este tipo de seguro. Liability insurance in Spanish. […]

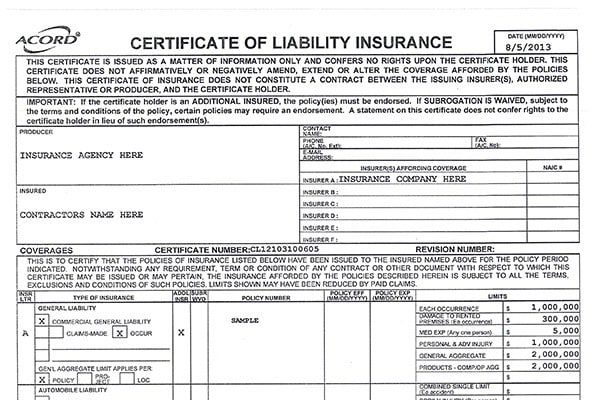

¿Cómo obtener un Certificado de Seguro de Contratista?

Si eres un contratista, es importante que tengas un Certificado de Seguro de Contratista para proteger tu negocio y a tus clientes en caso de accidentes o daños. En este artículo, te explicamos cómo obtener este certificado y por qué es esencial para tu negocio. ¡No esperes más para proteger tu empresa! Comprende qué es […]

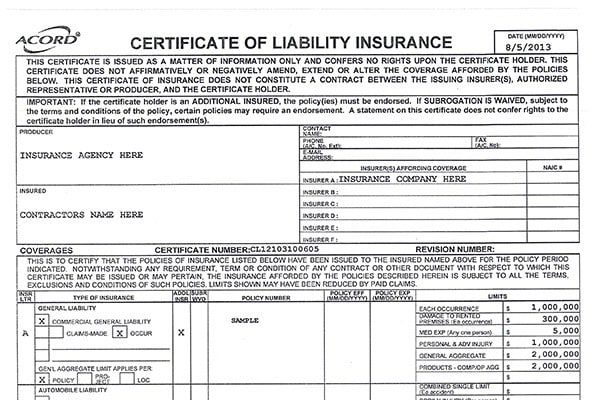

Contractor Insurance Certificates: What Are They?

If you work as a subcontractor or artisan contractor, you may be required to provide a contractor insurance certificate before you can receive payment for your services. This certificate serves as proof that you have the necessary insurance coverage to protect yourself and your clients in case of accidents or damages. Here’s what you need […]