A Comprehensive Guide to Construction Insurance Types

Construction is a high-risk industry, and accidents can happen at any time. That’s why it’s important to have the right insurance coverage to protect your business and employees. In this guide, we’ll cover the essential types of construction insurance, including general liability, workers’ compensation, and more. The Most Important Construction Insurance Type – General Liability […]

General Liabilities Definition: What You Need to Know

General Liabilities Definition: What You Need to Know When it comes to running a business, there are numerous risks that can arise at any moment. From accidents that occur on your premises to lawsuits filed by dissatisfied customers, it’s essential to understand the concept of general liabilities. Simply put, general liabilities refer to the legal […]

Last Mile Delivery Insurance: What You Need to Know

If you’re a last mile delivery driver, you know that accidents can happen on the road. That’s why it’s important to have the right insurance coverage to protect yourself and your business. In this guide, we’ll cover everything you need to know about last mile delivery insurance, including what it is, why you need it, […]

Why GEICO Insurance Commercial Auto is Good for Your Business

As a business owner, it’s essential to have the right insurance coverage to protect your assets and investments. One of the most critical types of insurance for any business that operates vehicles is commercial auto insurance. When it comes to finding the right insurance policy for your business, GEICO commercial auto insurance is an option […]

Insurance For Tree Service: A Comprehensive Guide

As a tree service provider, you have a dangerous job that requires specialized skills and equipment. While you may be experienced and cautious, accidents can still happen. Get an insurance quote now for tree trimming, call AmeriAgency at 888-851-5572. When they do, having the proper insurance coverage can mean the difference between a minor setback […]

Commercial Truck Insurance in Ohio: The Requirements

If you’re operating a commercial truck in Ohio, it’s important to have the right insurance coverage to protect yourself and your business. Ohio has specific insurance requirements for commercial trucks, and failing to meet them can result in fines and legal issues. Learn what you need to know about commercial truck insurance in Ohio with […]

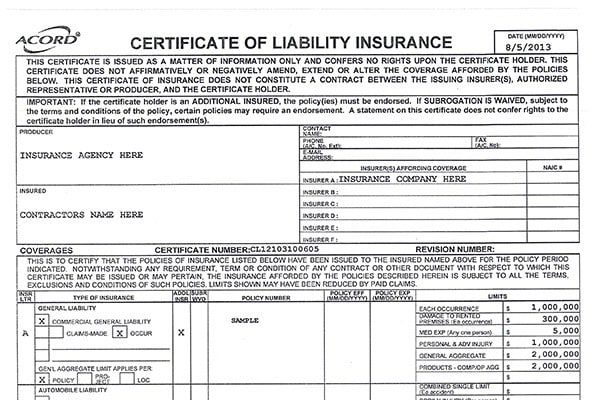

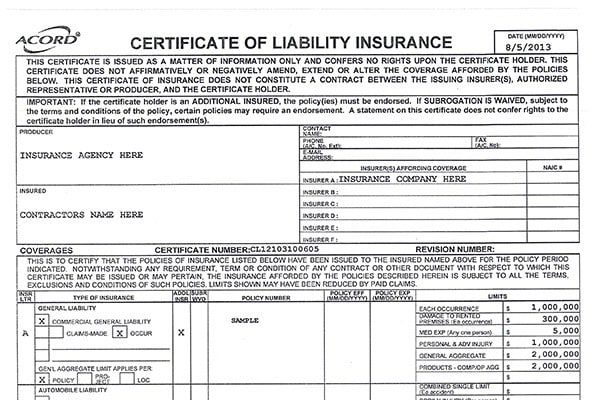

Contractor Insurance Certificates: What Are They?

If you work as a subcontractor or artisan contractor, you may be required to provide a contractor insurance certificate before you can receive payment for your services. This certificate serves as proof that you have the necessary insurance coverage to protect yourself and your clients in case of accidents or damages. Here’s what you need […]

Contractor Insurance Limits: The Essential Guide to Understanding

As an independent contractor, having the right contractor insurance limits is essential to protect your livelihood. Understanding exactly what is and isn’t covered by your policy, as well as other best practices for proper insurance coverage, will help you stay secure and successful in any job. Insurance For Restoration Contractors: The Essential Policies. What is […]

Understanding the Types of Box Truck Insurance for Amazon

As an Amazon delivery driver, having the right insurance coverage for your box truck is essential in order to keep your business protected. Learn about the different types of Prime truck insurance available to keep you and your business safe while delivering Amazon goods. Get the Amazon box truck insurance requirements now. Do you need […]

Commercial Lines: What Business Owners Need to Know

Commercial Lines of Insurance – Navigating the complex landscape of commercial lines insurance can be daunting for business owners. From property and liability coverage to specialized policies for unique business needs, finding the right insurance can seem like deciphering a hidden code. Understanding the intricacies of commercial insurance is vital to safeguarding a business from […]