What Does Contractor Insurance Cover: The Fine Print

What Does Contractor Insurance Cover – as a contractor, you know that accidents can happen at any time, whether you’re working on a construction site or in a client’s home. That’s why contractor insurance is essential for protecting your business and ensuring that you’re prepared for any unexpected event. But what exactly does contractor insurance […]

Contractor Insurance Texas: Protect Your Business

Contractor Insurance Texas: As a contractor in Texas, you understand the importance of protecting your business. From accidents on the job site to lawsuits from dissatisfied clients, there are a myriad of risks that can put your livelihood at stake. That’s why contractor insurance is essential for any business owner in the construction industry. With […]

A Comprehensive Guide to Construction Insurance Types

Construction is a high-risk industry, and accidents can happen at any time. That’s why it’s important to have the right insurance coverage to protect your business and employees. In this guide, we’ll cover the essential types of construction insurance, including general liability, workers’ compensation, and more. The Most Important Construction Insurance Type – General Liability […]

Contractor Workers Compensation Insurance: Contractor Best

As a contractor, you know that accidents can happen on the job. That’s why it’s important to have contractor workers compensation insurance to protect your business and employees. With the right coverage, you can have peace of mind knowing that your workers are protected in case of injury or illness on the job. Find out […]

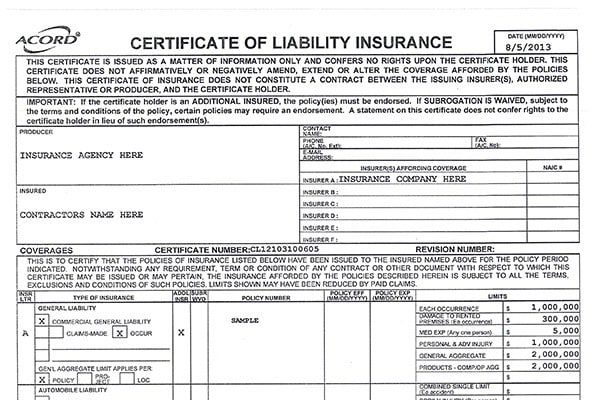

General Liability Contractors Insurance: A Comprehensive Guide

As a contractor, you know that accidents can happen on the job, no matter how careful you are. That’s why it’s important to have general liability insurance to protect your business and clients from financial losses due to property damage, bodily injury, or other incidents that may occur during a project. In this guide, we’ll […]

General Liability vs. Professional Liability: Which Do You Need?

As a business owner, it’s important to know general liability vs. professional liability to protect yourself from potential lawsuits and damages. Two common types of insurance coverage are general liability and professional liability. While both provide protection, they cover different types of risks. Read on to learn more about the differences between these two types […]

Concrete Contractor General Liability: How To Purchase

Concrete Contractor General Liability: How To Purchase – If you’re a concrete contractor, general liability insurance is an essential part of your business. It protects you from any financial losses that may arise due to property damage or bodily injury caused by your work. However, purchasing concrete contractor general liability insurance can be overwhelming, especially […]

How Much is Contractor Insurance: How Much Should You Pay?

How Much is Contractor Insurance: How Much Should You Expect to Pay? As a construction contractor, it’s essential to protect yourself, your employees, and your business from unexpected events that can lead to financial losses. That’s why contractor insurance is critical. However, the cost of insurance can vary depending on several factors, such as the […]

General Liability Waiver of Subrogation: What is the Importance?

Are you a business owner, contractor, or property owner? Have you ever heard of a general liability waiver of subrogation? If not, it’s time to take notice. A general liability waiver of subrogation is a clause that can protect you and your business from potential lawsuits and claims. It’s a legal document that releases one […]

Do I need insurance as a contractor? Here is the Answer.

As a contractor, you may be wondering if you really require insurance. The answer is a resounding yes! Without proper coverage, you could be putting yourself and your business at risk. In this guide, we’ll explore the reasons why insurance is essential for contractors and the types of coverage you should consider. Click here for […]