What insurance do I need as a contractor? Key Guide

As a contractor, it’s important to have the right insurance coverage to protect yourself and your business. From liability insurance to workers’ compensation, this guide will help you understand the different types of insurance you may need and how to choose the right policies for your specific needs. General Liability Insurance. General liability insurance is […]

Texas Contractor Insurance: Coverage Options and Costs

As a contractor in Texas, it’s important to protect your business with the right insurance coverage. From liability to property damage, there are a variety of risks that come with running a contracting business. Learn about the different types of Texas contractor insurance available and the costs associated with each option. Click here for contractors […]

Tree Service Business Insurance: Comparing Quotes

Running a tree service business can be a risky venture, with potential hazards like falling branches and equipment accidents. That’s why it’s crucial to have the right insurance coverage to protect your company from financial losses. But how much does tree service business insurance cost, and what should you look for when comparing quotes? Read […]

Why a Preferred Contractors Insurance Company is Best

As a contractor, you understand the importance of having the right insurance coverage to protect your business. But with so many options out there, how do you choose the best insurance company for your needs? A preferred contractors insurance company may be the ideal choice, offering tailored coverage and specialized services to meet the unique […]

Contractor Insurance Audit: What You Need Do

As a contractor, it’s important to make sure you have the right insurance coverage to protect your business and clients. One way to ensure you have adequate coverage is through a contractor insurance audit. In this article, we’ll cover the basics of why an audit is essential and what you can expect during the process. […]

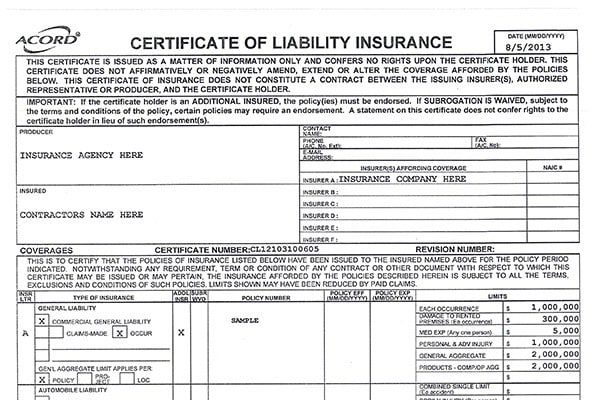

Contractor Insurance Limits: The Essential Guide to Understanding

As an independent contractor, having the right contractor insurance limits is essential to protect your livelihood. Understanding exactly what is and isn’t covered by your policy, as well as other best practices for proper insurance coverage, will help you stay secure and successful in any job. Insurance For Restoration Contractors: The Essential Policies. What is […]

Contratistas de Concreto: Expertos en la Construcción

Los contratistas de concreto son profesionales altamente capacitados en la construcción de estructuras de concreto. Desde la colocación de cimientos y paredes hasta la creación de patios y entradas de vehículos, los contratistas son esenciales en el proceso de construcción de una propiedad. En este artículo, exploraremos qué son los contratistas, qué hacen y por […]

Contractor GL and Work Comp: The Most Important Coverages

Contractor General Liability and Work Comp – Being a construction contractor comes with its own set of risks and challenges. From accidents on the job site to property damage and legal liabilities, there are numerous situations that can put your business at risk. That’s why having the right insurance coverage is essential for construction contractors. […]

Roofers Workers Comp Insurance – What You Should Know

As a roofer, it’s important to make sure you have the proper Roofers Workers Comp Insurance. Here’s what you need to know about this type of coverage, the kinds of coverage available, and the benefits for having workers comp insurance for your business. What is Roofers Workers Comp Insurance? Workers Comp Insurance is a form […]

Framing Contractor Insurance – What Types Do I Need?

Framing contractors should make sure they have the right insurance to protect themselves and their business. This guide will explain the different types of framing contractor insurance, how much coverage you should get, and where to find it. Framing Contractor Insurance: General Liability Insurance General liability insurance is a must for framing contractors, as it […]