Arthur J. Gallagher: Exploring the Success

Arthur J. Gallagher – Welcome to the world of Arthur J. Gallagher, where success is not just a destination but a way of life. In this article, we will delve deep into the remarkable journey of one of the leading insurance brokerage and risk management firms in the world. With over 60 years of experience, […]

Insurance for a Commercial Vehicle: A Comprehensive Guide

Insurance for a Commercial Vehicle – When it comes to insuring a commercial vehicle, there’s no room for shortcuts or guesswork. Whether you own a small business with a single delivery van or a fleet of trucks, having the right insurance coverage is essential to protect your assets and keep your operations running smoothly. But […]

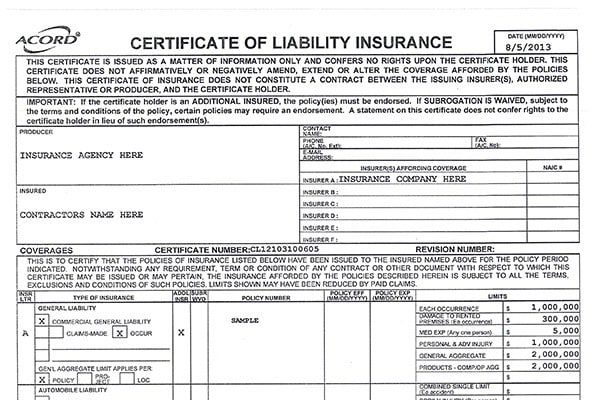

General Liability vs. Professional Liability: Which Do You Need?

As a business owner, it’s important to know general liability vs. professional liability to protect yourself from potential lawsuits and damages. Two common types of insurance coverage are general liability and professional liability. While both provide protection, they cover different types of risks. Read on to learn more about the differences between these two types […]

Commercial Truck Insurance in Ohio: The Requirements

If you’re operating a commercial truck in Ohio, it’s important to have the right insurance coverage to protect yourself and your business. Ohio has specific insurance requirements for commercial trucks, and failing to meet them can result in fines and legal issues. Learn what you need to know about commercial truck insurance in Ohio with […]

GEICO Commercial Auto Insurance – Review

Are you considering GEICO for your commercial auto insurance? You may be wondering what kind of plans are available, and if they fit your business’s needs. Here, we take a look at their coverage options, as well as any additional discounts or benefits that come with choosing GEICO. Overview of GEICO Commercial Auto Insurance. GEICO […]

Commercial Lines: What Business Owners Need to Know

Commercial Lines of Insurance – Navigating the complex landscape of commercial lines insurance can be daunting for business owners. From property and liability coverage to specialized policies for unique business needs, finding the right insurance can seem like deciphering a hidden code. Understanding the intricacies of commercial insurance is vital to safeguarding a business from […]

Seguro de Auto Comercial: Todo lo que Necesitas Saber

Seguro de Auto Comercial – Para cualquier negocio que dependa de vehículos comerciales, contar con un seguro de auto comercial es esencial para proteger tanto los vehículos como la empresa en sí. Desde cobertura de responsabilidad civil hasta protección contra daños físicos, comprender los entresijos del seguro de auto comercial es fundamental para garantizar la […]

Business Auto Tennessee: Volunteer State Discounts

Business Auto Tennessee AmeriAgency offers commercial auto insurance designed to suit the needs of commercial drivers or business owners who may employ drivers for transportation of cargo or construction material in the state of Texas. We offer coverage for a variety of commercial vehicles used to conduct business including: cars, pick-up trucks, vans, landscaping trucks, utility trailers, […]

Texas Auto Insurance Quotes: Lower Your Premiums

Texas Auto Insurance Quotes – How to Lower Your Auto Insurance Rates Are you tired of paying exorbitant amounts for your auto insurance? Well, you’re not alone. Many people are looking for ways to lower their premiums without compromising on coverage. Thankfully, there are some secrets to unlocking significant savings on your auto insurance rates. […]

Insurance Auto Repair Shop: Guide Auto Repair Insurance

Insurance Auto Repair Shop – As a small business owner, safeguarding the success of your venture is paramount. And one essential aspect of protecting your business is having the right insurance coverage. But with so many options and policies available, it can be overwhelming to navigate the insurance landscape. That’s where we come in. In […]