General Liability Covers: The Importance of GL Insurance

As a business owner, you have invested a lot of time, money, and effort into building your company. You have worked hard to create a product or service that meets the needs of your customers and provides value to the community. However, with the many risks that come with running a business, it is important […]

General Liabilities Definition: What You Need to Know

General Liabilities Definition: What You Need to Know When it comes to running a business, there are numerous risks that can arise at any moment. From accidents that occur on your premises to lawsuits filed by dissatisfied customers, it’s essential to understand the concept of general liabilities. Simply put, general liabilities refer to the legal […]

Seguro de Auto Comercial: Todo lo que Necesitas Saber

Seguro de Auto Comercial – Para cualquier negocio que dependa de vehículos comerciales, contar con un seguro de auto comercial es esencial para proteger tanto los vehículos como la empresa en sí. Desde cobertura de responsabilidad civil hasta protección contra daños físicos, comprender los entresijos del seguro de auto comercial es fundamental para garantizar la […]

Business Auto Tennessee: Volunteer State Discounts

Business Auto Tennessee AmeriAgency offers commercial auto insurance designed to suit the needs of commercial drivers or business owners who may employ drivers for transportation of cargo or construction material in the state of Texas. We offer coverage for a variety of commercial vehicles used to conduct business including: cars, pick-up trucks, vans, landscaping trucks, utility trailers, […]

Insurance Auto Repair Shop: Guide Auto Repair Insurance

Insurance Auto Repair Shop – As a small business owner, safeguarding the success of your venture is paramount. And one essential aspect of protecting your business is having the right insurance coverage. But with so many options and policies available, it can be overwhelming to navigate the insurance landscape. That’s where we come in. In […]

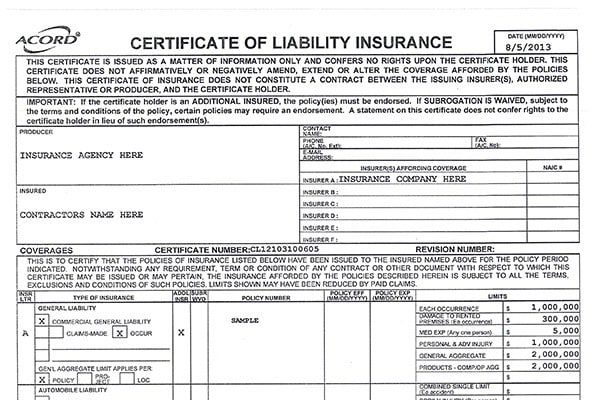

Contractor Insurance Quote: Ultimate Guide to Getting the Best

Contractor Insurance Quote – Are you a contractor looking for the best insurance coverage? Look no further! In this ultimate guide, we will walk you through the process of getting the best contractor insurance quote. Finding the right insurance can be overwhelming, but with the right knowledge and guidance, you’ll be able to protect yourself […]

Seguro Para Negocio Ohio: Que Necesitas Saber

Seguro Para Negocio Ohio – En un mundo empresarial incierto, proteger tu inversión es fundamental. El seguro de negocios puede ser la salvación en caso de desastres imprevistos, ayudándote a mantener tus operaciones y minimizando el impacto financiero. Pero, ¿qué necesitas saber sobre el seguro de negocios y cómo asegurar tu inversión? En este artículo, […]

Concrete Contractor Insurance: The 5 Essential Insurance Policies

Concrete Contractor Insurance – As a concrete contractor, you understand that accidents happen. One wrong move, and you could be facing expensive lawsuits, damage to property, or injury to yourself or your employees. That’s why having the right insurance policies in place is essential to protect your business, your assets, and your peace of mind. […]

Truck Insurance For Contractors

Truck Insurance For Contractors Truck Insurance For Contractors Click Here Now Or Call AmeriAgency At 888-851-5572 To Start Saving Up To 27% On Truck Insurance For Contractors COMMERCIAL VEHICLES INSURANCE Here’s a partial list of commercial vehicles insurance we provide: Click Here Now Or Call AmeriAgency At 888-851-5572 To Start Saving Up To 27% On […]

Auto Glass Shop Insurance: Find Unique Coverages You Require

Auto Glass Shop Insurance – Are you a business owner looking for ways to reduce your insurance costs? It’s crucial to understand the factors that impact your business insurance estimate. By knowing what affects the cost of your policy, you can take steps to lower it without sacrificing coverage. In this article, we will explore […]