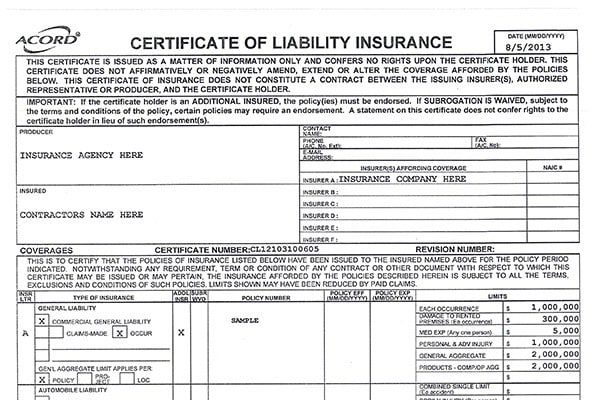

General Liability Insurance for Construction

Construction work can be dangerous, and accidents can happen even with the most careful planning and execution. That’s why it’s important for construction businesses to have general liability insurance, which can provide protection against unexpected accidents and lawsuits. In this post, we’ll explore what general liability insurance is, why it’s significant for construction businesses, and […]

How Much General Liability Insurance for Small Business?

How Much General Liability Insurance for Small Business As a small business owner, there are many factors to consider when it comes to protecting your company. One of the most important is general liability insurance, which can help safeguard your business against a range of potential risks and liabilities. But with so many options and […]

Business Insurance Agents In Tennessee

Business Insurance Agents In Tennessee – The best is AmeriAgency. AmeriAgency has more than 25 years of experience working with various businesses in different sectors. Our business insurance agents are specialized to find you the best coverage with the AmeriAgency Advantage process. Here are a couple of questions you should ask your agent before purchasing […]

Store Insurance In Gatlinburg: Your Business Insurance Guide

Store Insurance In Gatlinburg – As a small business owner, safeguarding your success is paramount. One crucial aspect of protecting your business is having the right insurance coverage in place. In this article, we will provide valuable tips and insights to help you navigate the complex world of insurance and ensure your business is adequately […]

Seguro Para Negocio Nevada: Consejos Para Ahorrar

Seguro Para Negocio Nevada – ¿Tienes un negocio propio? Si es así, sabes lo importante que es proteger tu inversión. El seguro de negocios puede ser la clave para mantener tu empresa a salvo en caso de imprevistos. En este artículo te contaremos todo lo que necesitas saber sobre el seguro de negocios y cómo […]

Business Insurance Virginia: Navigating Complex Insurance

Business Insurance Virginia – If you’re a business owner in Virginia, protecting your investment should be a top priority. With the ever-changing landscape of the business world and the potential risks that come with it, having business insurance is essential. Whether you own a small startup or an established company, having the right insurance coverage […]

Business Insurance Alabama: The Risks and Challenges

Business Insurance Alabama – As a business owner in Alabama, protecting your investment is of the utmost importance. One way to do this is by having the right insurance coverage in place. Business insurance in Virginia is not only essential but also a legal requirement for many types of businesses. Having business insurance provides you […]

Business Insurance Mississippi

Business Owners policy, commonly called a “BOP”, contains many of the insurance coverages needed by most small businesses. While these policies are not standard, there is great variation from insurance company to insurance company; there are certain common elements. The basic BOP offers business property for both building and contents, and liability insurance protection for […]

Business Insurance Austin: Mitigate the Financial Risks

Business Insurance Austin – Are you a business owner in Austin? If so, it’s important to be aware of the potential financial risks that your business may face. From property damage to legal claims, unforeseen events can seriously impact your bottom line. That’s why having the right business insurance in place is crucial. Business insurance […]

Business Insurance San Antonio

A Business Owners Policy for your business, sometimes called a BOP, provides several important insurance protections for: buildings, personal business property, business interruption, bodily injury liability and property damage liability. These policies are designed especially for small and medium sized businesses, and can be customized to fit the needs of a wide variety of commercial […]